Free Law & Tax Crash Course™

Wills Vs. Trust

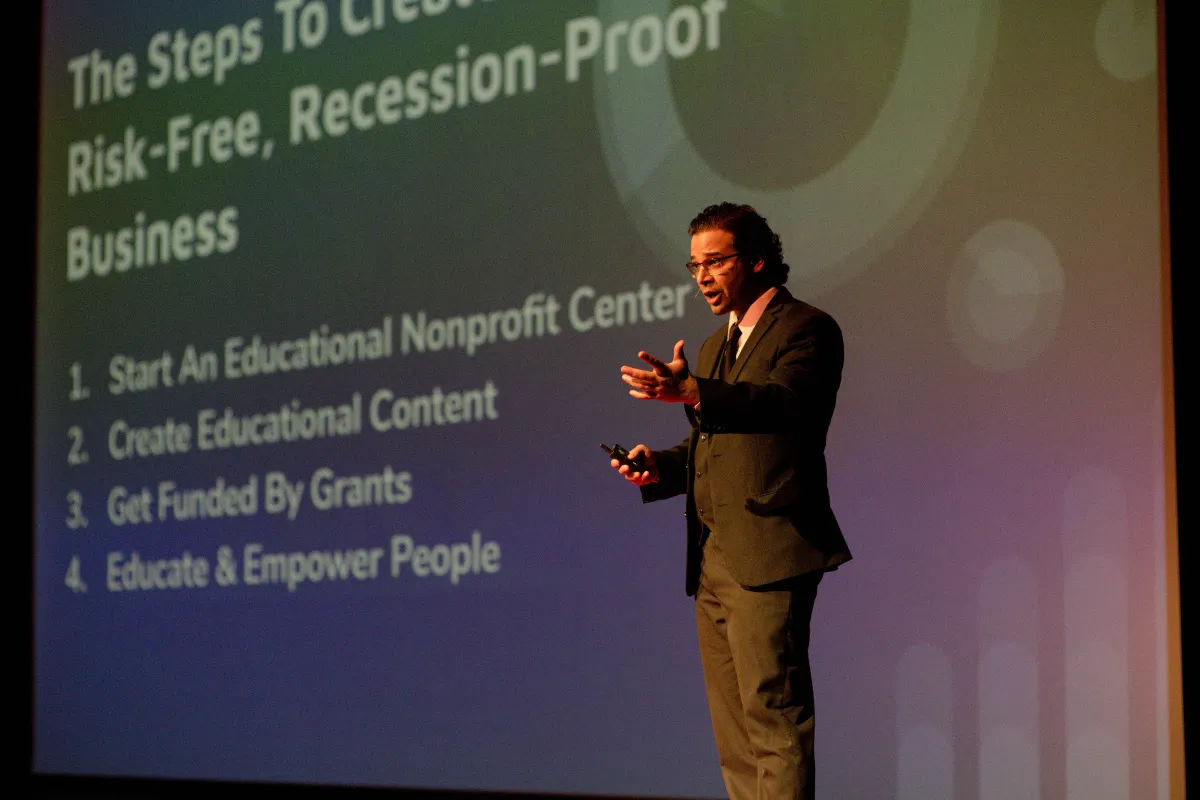

Course Instructor: Sid Peddinti

Business & Tax Attorney, Investor, TEDx Speaker & Philanthropist

This crash course will teach you how to:

Wills and trusts are different

These structures take effect

You can leverage these legal structures in different situations

What is a Will?

A will is a legal document that specifies how a person's assets and property should be distributed after their death. The main purposes of a will are to:

Name beneficiaries - The will names the individuals or organizations that will receive the deceased person's assets and possessions. This includes money, real estate, investments, heirlooms, etc.

Appoint an executor - An executor is the person responsible for carrying out the terms of the will after the testator (person who made the will) passes away. The executor oversees the probate process and distribution of assets.

Provide funeral and burial instructions - The will can specify the testator's wishes for funeral arrangements and organ donation.

Name guardians for minor children - If the deceased has minor children, the will states who should care for them and manage any inheritance left to them.

Make bequests - The will outlines specific gifts, called bequests, to be given to named beneficiaries. This includes who gets particular personal possessions or sums of money.

Establish trusts - A trust can be set up in a will to manage assets for beneficiaries until they reach a certain age.

Minimize estate taxes - Proper estate planning in a will helps minimize tax liabilities after death.

Choose an estate administrator - Someone needs to manage and settle the estate. The will names an estate administrator if different from the executor.

The will needs to be signed by the testator and witnessed according to state laws. It can be updated and changed during one's life as circumstances change. Wills must be probated after death and an official copy is kept by the probate court.

What is a Will?

A trust is a legal entity that allows a third party (the trustee) to hold assets on behalf of the trust's beneficiaries. Trusts are created and governed by a trust agreement that outlines how the assets are to be managed and distributed. Here are some key features of trusts:

Grantor - The person who creates the trust, also called the settlor, trustor, or donor. They transfer legal ownership of assets to the trust.

Trustee - The person or institution who manages and administers the assets in the trust. They have a fiduciary duty to manage the trust in the best interests of the beneficiaries.

Beneficiaries - The people or organizations who receive benefits from the assets in the trust. The trust agreement specifies how and when they will receive distributions.

Trust assets - These are the properties, money, investments or other holdings that are placed into the trust by the grantor. The trustee manages and distributes these assets according to the trust terms.

Trust agreement - This legal document creates the trust and provides instructions for how the trustee must manage the trust. It names all parties involved and outlines distribution rules.

Revocable vs irrevocable - A revocable trust can be changed or terminated by the grantor, while an irrevocable trust cannot be modified after it is created.

Trusts are used for estate planning purposes like avoiding probate, minimizing taxes, protecting assets, and setting up inheritance distributions. Different types of trusts include living trusts, marital trusts, spendthrift trusts, and special needs trusts.

7 Key Differences Between Wills and Trusts:

Here are 7 key differences between wills and trusts:

A will goes into effect only after you die

A will must go through probate

A will only distributes assets, it does not control them

A will does not place conditions or restrictions on gifts

Use a will to minimize the amount of taxes

Wills become public records once they enter probate

Wills are easier to contest in court than trusts.

A trust takes effect as soon as it is signed and funded.

A trust avoids probate

With a trust, you can control assets even after your death

A trust allows you to place conditions or restrictions on gifts

A trust can be used to minimize estate taxes

A trust offers more privacy

It's more complicated to dispute a revocable living trust

Why a Trust is better than a Will?

Trusts offer a number of benefits over wills, including:

Avoid probate: Trusts avoid probate, which is the court process of distributing a person's assets after they die. Probate can be a time-consuming and expensive process, and it can be even more complicated if the person's estate is large or complex.

Protect assets: Trusts can help to protect assets from creditors, lawsuits, and other claims. This is because the assets in a trust are not considered part of the person's estate after they die.

Provide for minors and disabled beneficiaries: If you have minor children or disabled beneficiaries, you can use a trust to provide for them after you die. The trust can allow you to control how and when your assets are distributed to them, and it can also help to ensure that they are used for their benefit.

Provide flexibility: Trusts can be very flexible, and they can be tailored to meet your specific needs. For example, you can create a trust to distribute your assets to your beneficiaries immediately after you die, or you can create a trust that will continue to manage your assets for many years after you die.

Overall, trusts offer a number of advantages over wills. Trusts can help you to avoid probate, protect your assets, provide for your minor children and disabled beneficiaries, and provide flexibility in your estate planning. If you have a complex estate or if you have minor children or disabled beneficiaries, a trust is likely to be a better option for you than a will.

Why a Will is better than a Trust?

Wills have a number of advantages over trusts, including:

Cost: Wills are less expensive to create and maintain than trusts.

Simplicity: Wills are generally simpler than trusts, and they are easier to understand and manage.

Privacy: Wills are public documents, while trusts are not. This means that your beneficiaries will not be able to see the terms of your trust until after you die.

Flexibility: Wills can be changed or revoked at any time, while trusts may be more difficult or impossible to change once they are created.

Overall, wills offer a number of advantages over trusts for people with simple estates and no minor children or disabled beneficiaries. Wills are less expensive, easier to create and manage, and more flexible than trusts.

7 Benefits of a Will

7 Benefits of a Trust

Distribute assets according to your wishes. Without a will, your assets will be distributed according to state law, which may not be in line with your wishes.

Avoid probate. Probate is the court process of distributing a person's assets after their death. It can be time-consuming and expensive, and it can also be complicated if the person's estate is large or complex. A will can help to avoid probate, which can save your loved ones time and money.

Protect your minor children. If you have minor children, you can use a will to appoint a guardian for them. This will ensure that someone you trust will be responsible for raising your children if you die before they reach adulthood.

Provide for disabled beneficiaries. If you have disabled beneficiaries, you can use a will to create a special needs trust for them. This type of trust can help to ensure that your beneficiaries' assets are not disqualified from government benefits.

Reduce estate taxes. If your estate is large enough to be subject to estate taxes, you can use a will to minimize the amount of taxes that your beneficiaries will have to pay.

Leave a legacy. You can use a will to make charitable donations or to leave gifts to specific people or organizations. This is a great way to make a difference in the world and to leave a lasting legacy.

Ease of mind. Knowing that you have a will in place can give you peace of mind. You can rest assured that your assets will be distributed according to your wishes and that your loved ones will be taken care of after you die.

Avoid probate. Trusts avoid probate, which is the court process of distributing a person's assets after they die.

Protect assets from creditors and lawsuits. Assets in a trust are generally protected from creditors and lawsuits. This means that if you are sued or if you have debts, your creditors will not be able to go after the assets in your trust.

Provide for minors and disabled beneficiaries. If you have minor children or disabled beneficiaries, you can use a trust to provide for them after you die. The trust can allow you to control how and when your assets are distributed to them, and it can also help to ensure that they are used for their benefit.

Minimize estate taxes. If your estate is large enough to be subject to estate taxes, you can use a trust to minimize the amount of taxes that your beneficiaries will have to pay.

Provide flexibility. Trusts can be very flexible, and they can be tailored to meet your specific needs. For example, you can create a trust to distribute your assets to your beneficiaries immediately after you die, or you can create a trust that will continue to manage your assets for many years after you die.

Maintain privacy. Trusts are not public documents, which means that your beneficiaries will not be able to see the terms of your trust until after you die.

Provide for incapacity. If you become incapacitated, a trustee can manage your trust assets on your behalf. This can help to ensure that your financial needs are met even if you are unable to manage your own finances.

The Pitfalls of Wills

Wills are an important part of estate planning, but they are not without their pitfalls. Here are some of the most common pitfalls to avoid when creating a will:

Failing to create or update a will. One of the biggest pitfalls is failing to create a will at all, or failing to update an existing will when your circumstances change. If you die without a will, your assets will be distributed according to state law, which may not be in line with your wishes.

Not naming a guardian for minor children. If you have minor children and you do not name a guardian in your will, the court will appoint a guardian for them. This may not be the person you would have chosen to raise your children.

Not providing for disabled beneficiaries. If you have disabled beneficiaries, it is important to make provisions for them in your will. This may include creating a special needs trust to ensure that their assets are not disqualified from government benefits.

Not naming a backup executor. If you name an executor in your will and that person is unable or unwilling to serve, it is important to name a backup executor. Otherwise, the court will appoint an executor, which may delay the distribution of your assets.

Making vague or unclear language. When writing your will, it is important to use clear and concise language. Avoid using vague or ambiguous language, as this can lead to disputes and litigation after your death.

Not signing your will properly. In order for a will to be valid, it must be signed by the testator (the person making the will) and witnessed by two disinterested parties.

Not storing your will in a safe place. Once you have created your will, it is important to store it in a safe place where it can be easily found after your death.

The Pitfalls of Trusts

Trusts can be a valuable estate planning tool, but they also have some potential pitfalls. Here are some of the most common pitfalls to avoid when creating and managing a trust:

Choosing the wrong trustee. The trustee is the person or institution responsible for managing the trust assets and carrying out the terms of the trust agreement. It is important to choose a trustee who is honest, trustworthy, and competent. You should also consider the trustee's availability and willingness to serve

Not drafting the trust agreement carefully. The trust agreement is a complex legal document, and it is important to have it drafted by an experienced estate planning attorney. The trust agreement should clearly outline the terms of the trust, including the trustee's powers and duties, the beneficiaries' rights, and the distribution of assets.

Failing to fund the trust properly. Once you have created a trust, you need to fund it by transferring assets to the trust. If you fail to fund the trust properly, the trust will be empty and will not be able to achieve its purpose.

Not managing the trust assets properly. The trustee has a fiduciary duty to manage the trust assets prudently and in the best interests of the beneficiaries. This means that the trustee must invest the trust assets appropriately and must avoid making any self-dealing transactions.

Not distributing the trust assets according to the trust terms. The trustee has a duty to distribute the trust assets to the beneficiaries according to the terms of the trust agreement. If the trustee fails to do this, the beneficiaries may have a claim against the trustee.

SCHEDULE A COMPLIMENTARY CALL WITH OUR TRUST EXPERTS

Take A Free Estate & Tax Evaluation

Get High-Level Estimates of How Various Tax Obligations Can Be Shifted Legally & Ethically Between Corporations, Individuals, Estates & Trusts, and Tax-Exempt Entities

Copyrighted Material © 2023 . All rights reserved. Law and Tax Consulting