Law and tax research foundation

100% FREE, COMPLIMENTARY, AND EDUCATIONAL RESEARCH PROVIDED BY NONPROFITX AND ATTORNEY SIDHARTHA "SID" PEDDINTI, aka THE LEGAL WATCHDOG™.

ON THIS PAGE, YOU'LL FIND FREE INFORMATION AND EDUCATIONAL CONTENT THAT COVERS SCAMS, FRAUDS, AS WELL AS COURT CASES AND IRS RULING TO HELP YOU GAIN ACCESS TO THE LAW - THE REAL LAW - AND MAKE GOVERNMENT COMPLIANT DECISIONS.

TOPICS INCLUDED:

Wills, trusts, tax codes, estate taxes, gift taxes, control vs ownership, included in the estate vs removed, completed gift vs incomplete, insurance scams, trust law and scams, IRS tests and publications, guides and letters, court cases, and tax codes, etc.

Want access to more cases and resources related to investments, LLC structures, partnerships, business succession, gifting startegies, and foundations? Send us a message and we'll be happy to help: [email protected]

List of scams and schemes on the IRS website called Dirty Dozen

"GRANTORS" ACCORDING TO THE IRS

1:

26 U.S. Code Subpart E - Grantors and Others Treated as Substantial Owners

2:

F. Trust Primer by

Elise Lin, Ron Shoemaker and Debra Kawecki

3:

IRS Definition of Grantor

This document contains final regulations defining the

term grantor

4:

IRS Publishes Proposed Regs on Trusts With Foreign Grantors

The IRS has published proposed regulations (REG-252487-96) implementing section 672(f), which relates to the application of the grantor trust rules to trusts established by foreign persons.

Cases where the trustee is treated as the grantor

(substance over form):

1:

FAMILY TRUST IS FOUND TO BE A SHAM; ADDITION TO TAX LEVIED FOR LATE FILING OF RETURN

2:

F. Trust Primer by

Elise Lin, Ron Shoemaker and Debra Kawecki

3:

IRS WARNS OF ABUSIVE TRUSTS.

4:

GRANTORS ARE TAXABLE ON INCOME FROM 'FAMILY' TRUST.

Standards and tests that the court will look at

1:

HUSBAND'S TRUST MUST BE DISREGARDED AS SHAM.

1. Petitioners' Unchanged Relationship to the Property Transferred 2. Lack of an Independent Trustee 3. No Economic Interest to Other Beneficiaries of the Trust 4. Petitioners' Unrestricted Use Of the Trust

2:

LEVY AGAINST TRUST PRINCIPAL WAS WRONGFUL; TAXPAYER HAS ONLY INCOME INTEREST.

IRS LETTERS AND SUPPORTING RESEARCH

1:

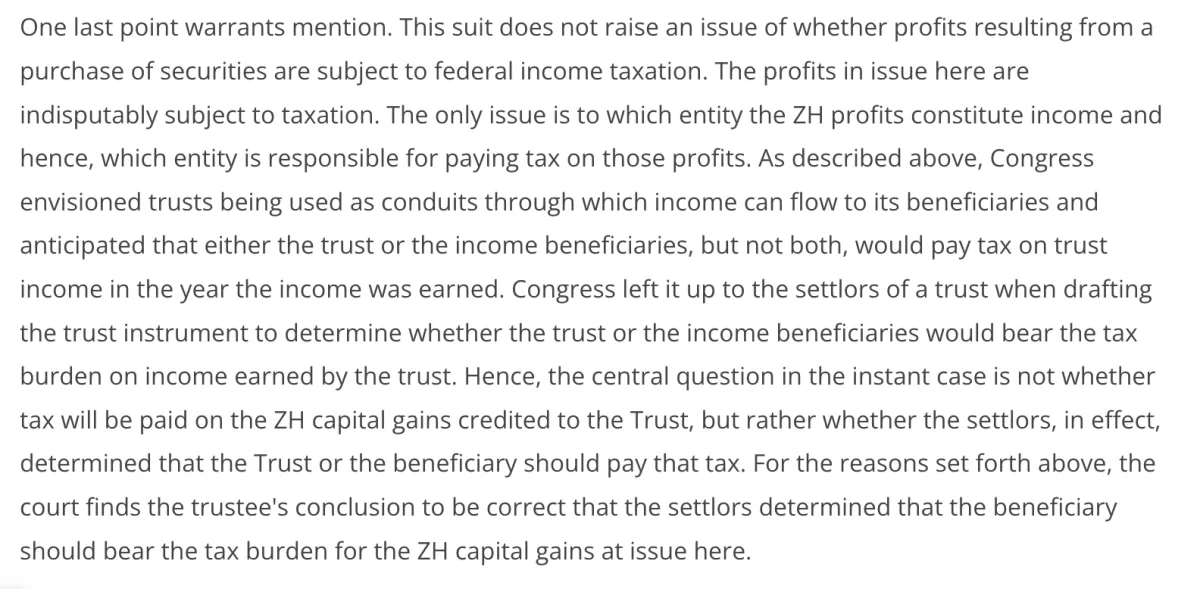

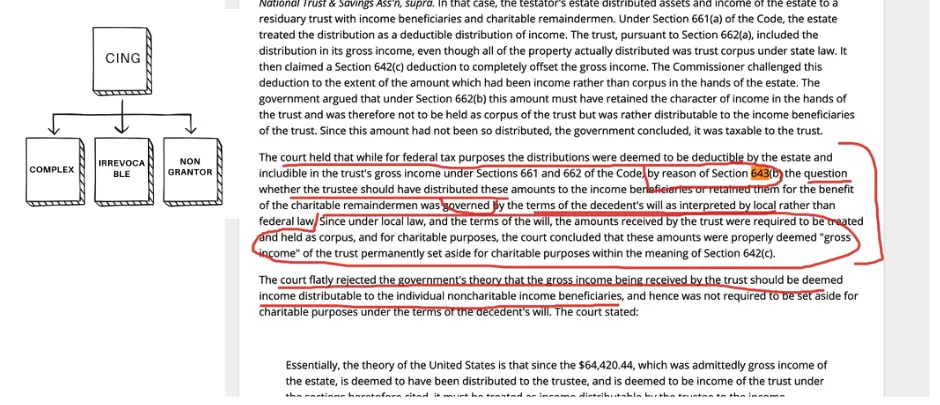

Trust describes WHO pays the taxes on stocks received by the trust - Grantor wanted beneficiaries to pay, IRS wants the trust to pay. Court said follow trust's language: beneficiaries pay.

2:

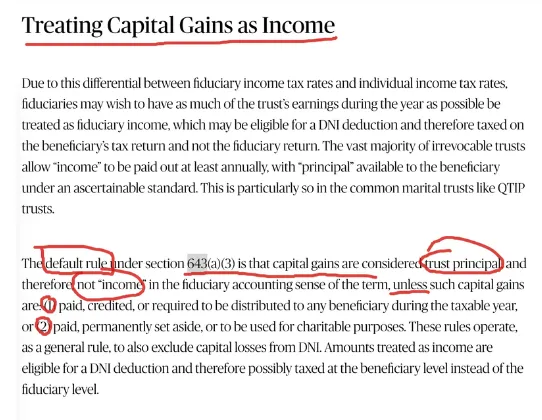

Nontaxable corporate distributions may NOT be used in calculation of DNI

In other words, the terms of the trust which defined DNI (taxable event) should be respected - in this case, it will not be included in DNI.

3:

Trustee cannot offset indirect expenses against cap gains in corpus

"In the instant case, the trust's capital gains are not included in the computation of distributable net income under the provisions of section 643(a)(3) of the Code."

In this specific case, expenses should be against DNI (this is a simple trust, not complex).

4:

Trust has multiple income sources (a,b,c), no distinction of income made in corpus (everything goes into one pool), expenses related to asset or income source should be taken as a % proportional to total. Affirmed.

"In the instant case the method of allocating indirect expenses between exempt and nonexempt income used by the taxpayer is consistent with the language and intent of section 212 of the Code.

Accordingly, it is held that the method of allocation used by the taxpayer, in the instant case, is reasonable within the meaning of section 1.265-1(c) of the regulations and is acceptable for computing the portion of his office expenses that is deductible under section 212 of the Code because there is no material distortion of income."

5:

Simple trust that has to distribute current income, but okay to hold cap gains in corpus, distributions of expenses made against corpus...

"In the instant case, the trust's capital gains are not included in the computation of distributable net income under the provisions of section 643(a)(3) of the Code. Therefore, the capital gains may not be included in the formula for allocating indirect expenses to tax-exempt income"

6:

Estate Cap gains are NOT part of DNI

"CONCLUSIONS: The distributable net income of X does not include the capital gains recognized by X upon the sale of securities held by X"

7:

Advice has been requested whether capital gains are excludable from distributable net income of a trust under the circumstances described below.

"Accordingly, under the facts set forth above, where income of the trust for its first taxable year is insufficient to make the annuity payment to B and in accordance with the agreement with her, the trustee distributes securities to her in partial satisfaction of the annuity payment, capital gain of 2 x dollars resulting from the transaction is includible in gross income of the trust but is excludable from its distributable net income."

8:

TRUST'S GRANTOR IS NOT OWNER

Except to the extent that Trust has unrelated business income within the meaning of section 681(a) of the Code, Trust will be allowed a deduction in accordance with section 642(c)(1) for amounts of gross income paid during the taxable year (or by the close of the following taxable year if the trustee so elects) to charitable organizations described in section 170(c).

9:

Allocation Of Depreciation Is A % From That Asset

"The ALLOCATION OF DEPRECIATION ruling concludes that the trustee, by charging mortgage principal payments to income, has accumulated income. The apportionment rules set out in

section 167(h) of the Code and the related regulations require, therefore, that a portion of the allowable depreciation deduction must be allocated to the trust, The portion so allocated will be determined by multiplying the total allowable depreciation by a fraction, the numerator of which is the amount of income accumulated, and the denominator of which is the total trust income determined under

section 643(b) and the related regulations."

CAPITAL GAIN SET-ASIDE QUALIFIES.

FOUNDATION'S SET-ASIDE PLAN QUALIFIES.

SCHOLARSHIP SET-ASIDE DENIED.

TRUST INCOME IS EXEMPT AS EXERCISE OF ESSENTIAL GOVERNMENT FUNCTION.

GRANTOR WILL BE OWNER OF TRUST INCOME AND CORPUS.

ASSIGNMENT OF TRUST INCOME RESULTS IN TRANSFER OF TAX LIABILITY.

INSURANCE PREMIUMS PAID FROM TRUST INCOME ARE NOT DEDUCTIBLE.

TRUST INCOME IS NOT SELF-EMPLOYMENT INCOME.

TRUST INCOME IS NOT SELF-EMPLOYMENT INCOME. - CASE 2

TRUST INCOME IS NOT SELF-EMPLOYMENT INCOME. - CASE 3

DEPRECIATION DEDUCTION MUST BE ALLOCATED TO TRUST PRINCIPAL WHEN MORTGAGE PAYMENTS ARE CHARGED AGAINST INCOME IN DETERMINING BENEFICIARY'S AMOUNT

CASE STUDIES

PAYMENTS RELATED TO TRUST-INCOME PRODUCTION ARE DEDUCTIBLE.

More Case Studies

CASE STUDIES

PAYMENTS RELATED TO TRUST-INCOME PRODUCTION ARE DEDUCTIBLE.

CASE STUDIES

Has G made a gift under section 2511 of the Code, when G subsequently relinquishes all remaining interests in the trust, including the right to receive discretionary income payments

CASE STUDIES

NOT A CHARITABLE TRUST

CASE STUDIES

deduction for depletion may be apportioned and allocated between the income beneficiaries and the trust is, under the terms of the trust instrumen

CASE STUDIES

computation and apportionment of the allowable deductions for depreciation and for depletion between an estate and its heirs, legatees and devisees, and between a trust and its income beneficiaries

CASE STUDIES

computation and apportionment of the allowable deductions for depreciation and for depletion between an estate and its heirs, legatees and devisees, and between a trust and its income beneficiaries

CASE STUDIES

If and when the grantor's dominion and control of the trust assets ceases, such as by the trustee's decision to move the situs of the trust to a State where the grantor's creditors cannot reach the trust assets, then the gift is complete for Federal gift tax purposes under the rules set forth in section 25.2511-2 of the regulations (quoted above).

CASE STUDIES

Accordingly, under the facts set forth above, where income of the trust for its first taxable year is insufficient to make the annuity payment to B and in accordance with the agreement with her, the trustee distributes securities to her in partial satisfaction of the annuity payment, capital gain of 2 x dollars resulting from the transaction is includible in gross income of the trust but is excludable from its distributable net income.

OTHER CASES

PURPORTED 'BUSINESS TRUST' IS ACTUALLY A GRANTOR TRUST; INCOME AND EXPENSES ATTRIBUTABLE TO GRANTOR.

TRANSFER OF FARM PROPERTY TO TRUST WAS A SHAM; TRUST INCOME IS ATTRIBUTABLE TO INDIVIDUALS.

[NO SEPARATE ACCOUNTING FOR TRUST WAS FILED]

TAX LEVY FAILS TO DEFEAT SPENDTHRIFT TRUST PROVISION IN OHIO.

[AMAZING CASE ON THE POWER OF SPENDTHRIFT TRUSTS]

LIST OF CASES TO RESEARCH:

TRUST PRINCIPAL TAXATION ISSUES

PURE TRUSTS SHAM

LIST OF CASES TO RESEARCH:

KEYWORD: CORPUS TAXES

LAWSUITS AGAINST CPAS AND PREPARERS

LIST OF CASES TO RESEARCH:

KEYWORD: CORPUS TAXES

LAWSUITS AGAINST CPAS AND PREPARERS

BANK'S TRANSFER OF FUNDS TO TRUST CORPUS IS NOT TAXABLE.

[incomplete gift]

BANK'S TRANSFER OF FUNDS TO TRUST CORPUS IS NOT TAXABLE.

[incomplete gift]

TAX CODES, LAWS, STATUES, ETC.

11:

IRS Document about Trusts

I used this document to form the basis of my interpretation about trusts and estates. In other words, your trust will be designed to comply with the interpretation taken by the IRS

12:

FEDERAL REGISTER

Definition of Income for Trust Purposes

13:

AMERICAN BAR ASSOCIATION

14:

FEDERAL REGISTER

15:

TEXAS TRUST CODE

Control + F [Search tool]

Sec. 116.153: Business and other activities conducted by trustee => the blueprint for the (business) trust is already contained in the code!

TAX SCAM =>> AVOID PURE TRUSTS THAT PROMOTE "NO TAXES UNDER FEDERAL LAW, ETC."

WHAT TO AVOID

GRANTOR TRUSTS: IRC Sections 671-679

Cases where grantor retains control = grantor trust

(taxes are attributable to the grantor)

Grantor trusts (all about control)

Read through case studies (scroll down)

Self-dealing (all about personal benefit)

Spotting abusive structures that do not follow these rules (read what the IRS says and how they warn people to spot these issues):

Paulson, Jon J., et ux. v. Comm.:

Petitioners Jon and Lynn Paulson transferred stocks and bonds to an irrevocable trust for the benefit of their children.

The trust agreement named the Paulsons as the trustees and gave them broad administrative powers over trust assets.

The IRS determined the transfer rendered the trust a “grantor trust” and taxable to the Paulsons.

The Tax Court upheld the IRS position, finding the broad powers kept by the Paulsons meant the transfer was not a completed gift.

Thus, the trust was a grantor trust and its income was taxable to the Paulsons under grantor trust rules in Sections 671-679.

Linmar Property Management Trust et al. v. Comm.:

Linmar involved five separate trusts set up by one grantor to own and operate real estate properties.

The IRS argued the trusts were grantor trusts because the grantor retained substantial control as trustee over trust assets.

The Tax Court agreed, finding the broad powers held by the grantor-trustee prevented the trusts from being recognized as separate entities for tax purposes.

Thus, the trusts were grantor trusts and their income was taxable to the grantor under the grantor trust rules.

Ghalardi Income Tax Education Foundation v. Comm.:

Ghalardi involved a charitable foundation formed to provide tax education and established as a non-grantor trust.

The IRS revoked the foundation's tax-exempt status because its activities furthered the private interests of its creators.

The Tax Court upheld the IRS revocation, finding the foundation was operated to avoid taxes, not provide public education.

Thus, the foundation did not qualify as a tax-exempt charitable organization under IRC Section 501(c)(3).

Whitehead, Eugene H., et ux., v. Comm.:

The Whiteheads created a trust for their grandchildren, funding it with shares in a publishing company.

They retained control as trustees over trust assets and income distribution.

The IRS determined the trust was a grantor trust, taxable to the Whiteheads under grantor trust rules.

The Tax Court agreed, finding the retained controls prevented the transfer to the trust from being a completed gift for tax purposes.

Wasson, Brian K. v. U.S.:

Wasson created a family trust and transferred assets to it, naming himself as trustee.

The trust agreement gave Wasson broad control and powers over the trust.

The IRS determined the trust was a grantor trust and taxable to Wasson based on his retained controls.

The Tax Court ruled in favor of the IRS, finding the trust was a grantor trust under the grantor trust rules in Sections 671-679.

Holman, Dr. Bruce, et ux. v. U.S:

The Holmans transferred property to a trust for their children's benefit, naming themselves as trustees.

The trust terms allowed them to retain control over the trust assets.

The IRS found the trust was a grantor trust, taxable to the Holmans based on their retained powers.

The Tax Court agreed with the IRS that the substantial controls kept by the Holmans meant the trust was a grantor trust under the tax code.

Christal, Neil J., II, et ux. v. Comm.:

The Christals transferred stock options to a trust for estate planning purposes.

They retained control as trustees over trust assets.

The IRS determined the trust was a grantor trust, taxable to the Christals based on their retained powers.

The Tax Court ruled in favor of the IRS, citing the Christal's controls as trustees made the trust a grantor trust under the tax code.

Leonard, Matthew, et ux. v. Comm.:

The Leonards created a trust for their children, funding it with shares in a family business.

They appointed themselves trustees and retained control over the trust assets.

The IRS found the trust was a grantor trust based on the powers kept by the Leonards as trustees.

The Tax Court upheld the IRS position that the retained controls caused the trust to be a grantor trust taxable to the Leonards.

Hobart A. Lerner, M.D., P.C., et al. v. Comm.:

Lerner involved a doctor who transferred his business assets to three trusts, naming himself trustee.

The trusts gave Lerner broad control and discretion over trust assets and income.

The IRS determined the trusts were grantor trusts taxable to Lerner based on his retained powers.

The Tax Court agreed with the IRS that the trusts were grantor trusts under the grantor trust tax rules.

Trustee Corp. v. Comm.:

A grantor created an irrevocable trust for his children, retaining control as trustee.

The trust owned stock in a company the grantor also controlled.

The IRS found the trust was a grantor trust taxable to the grantor based on his retained powers.

The Tax Court ruled in favor of the IRS, citing the grantor's broad controls as trustee over trust assets.

Roderick, Daniel J., et al. v. Comm:

Roderick involved a grantor who transferred assets to an irrevocable trust for his children.

The grantor named himself sole trustee and kept broad control over the trust.

The IRS determined the trust was a grantor trust taxable to the grantor based on his powers as trustee.

The Tax Court upheld the IRS position that the retained controls caused the trust to be a grantor trust under the tax code.

Bay, Susan L. v. Comm.:

Bay involved a grantor who created a trust for her children, funding it with interests in a family business.

The grantor appointed herself sole trustee and retained control over the trust assets.

The IRS determined the trust was a grantor trust, taxable to the grantor based on her powers as trustee.

The Tax Court agreed with the IRS that the retained controls meant the trust qualified as a grantor trust under the tax code.

Case: Roderick, Daniel J., et al. v. Commissioner

Issue: Applicability of favorable tax treatment under Section 170(h) of the Internal Revenue Code (IRC) to proceeds from a conservation easement sale.

Taxpayers argued for capital gains treatment under Section 170(h).

IRS contended the transaction lacked the required charitable intent.

Court ruled in favor of the IRS, finding that the conservation easement did not meet Section 170(h) requirements.

DiLeonardo, Sharon Purcell v. Comm. including specific facts and statutes:

Grantor Purcell created an irrevocable trust in 1980 for her four children, funding it with stock in a family-owned C corporation.

Purcell appointed herself sole trustee and retained powers under the trust agreement to control trust investments and determine trust income distributions.

Citing Sections 674 and 677 of the Internal Revenue Code, the IRS determined the trust was a grantor trust and taxable to Purcell based on her broad retained powers as trustee.

The Tax Court upheld the IRS position, ruling that Purcell's powers over trust assets and income as trustee caused the trust to be a grantor trust under the grantor trust rules.

FOLLOW US

COMPANY

CUSTOMER CARE

LEGAL

Copyright © 2025. NonprofitX is an initiative by several nonprofits, for-profits, and hybrid organizations - all on a mission to educate and empower the people with law, tax, and financial strategies.